How to enter the Polish market. Advice for the e-commerce industry

How to enter the Polish market. Advice for the e-commerce industry

In the last two decades, Poland has experienced major economic transformations. The surge in online shopping stands out as a significant shift, with 70% of Polish consumers now favouring e-commerce for its convenience and cost-effectiveness1.

Today, the e-commerce sector continues to flourish, driving economic growth and marking Poland’s journey into a more digitally driven future. As a result, many businesses are now eyeing the Polish market as an attractive destination to expand their online operations. Are you ready to join them? Read on to find out why Poland’s e-commerce market could be your next big opportunity!

Key information about Poland

Source: Google Maps screenshot

Is Poland in the EU?

Poland has been a member of the European Union (EU) since 1 May 2004. The country’s alignment with EU regulations facilitates smoother market entry and regulatory compliance, simplifying the process of doing business in Poland and offering access to the EU’s single market with its vast consumer base and economic opportunities.

Is Poland in the Schengen area?

Yes, Poland is part of the Schengen area. For businesses entering the Polish market, this means easier access to a larger European market without border controls, as well as simplified logistics and trade.

Yes, Poland is part of the Schengen area. For businesses entering the Polish market, this means easier access to a larger European market without border controls, as well as simplified logistics and trade.

Currency in Poland

Poland’s currency is the Polish zloty (PLN).

Poland’s currency is the Polish zloty (PLN).

As of now, Poland remains outside the Eurozone. Moreover, it’s not expected to switch its currency in the foreseeable future.

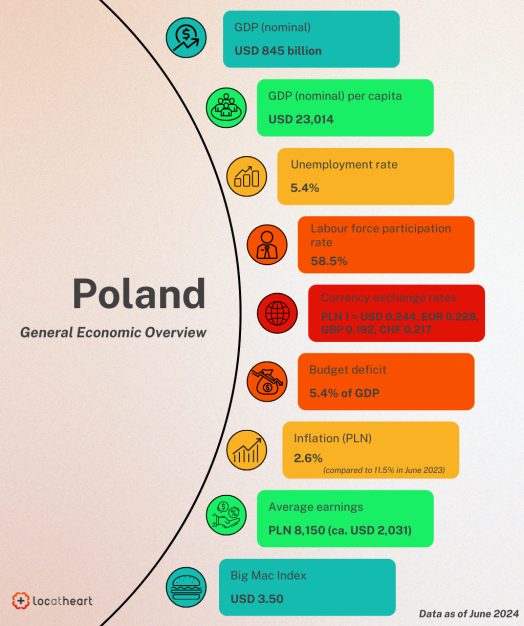

General economic overview

VAT in Poland

In Poland, Value Added Tax is referred to both as VAT and podatek od towarów i usług. The country follows VAT regulations set by the European Union under the VAT Directive, while maintaining the freedom to set its own VAT rates.

VAT rates in Poland

If you wish to learn more about VAT in Poland, we invite you to look here. As for the full list of VAT rates, please visit the official website.

Legal requirements

Data protection and privacy

In Poland, data protection is governed by the General Data Protection Regulation (GDPR, or RODO in Polish), aligning Polish law with EU standards. Compliance with RODO is mandatory for all entities handling personal data, promoting transparency and accountability in data processing practices.

The chief legal bases on which data may be processed are:

- consent of the subject;

- contractual obligation;

- compliance with a legal obligation;

- protection of the vital interests of the data subject;

- fulfilment of a task performed in the public interest;

- the legitimate interest of the data controller.

Poland has its own data protection supervisory authority called the Personal Data Protection Office (Urząd Ochrony Danych Osobowych, or UODO).

Consumer protection

The chief Polish institution responsible for consumer protection is the Office of Competition and Consumer Protection (Urząd Ochrony Konkurencji i Konsumentów, or UOKiK). According to the Polish law, the main consumer rights are:

- right to information: consumers have the right to clear and accurate information about goods or services, including pricing and terms;

- right to withdraw: consumers can withdraw from a contract within 14 days without giving a reason and without additional costs;

- right to warranty: consumers are entitled to a warranty for goods, covering defects that appear within a specified period after purchase;

- right to complaint: consumers can lodge complaints about non-conforming goods or services and expect a timely response.

Environmental regulations

Poland is gradually strengthening its environmental regulations to effectively tackle sustainability challenges and promote eco-friendly practices. Here are some key initiatives:

- Deposit Return System (DRS). Starting 1 January 2025, consumers will need to pay a deposit on single-use plastic bottles up to 3 litres, reusable glass bottles up to 1.5 litres, and metal cans up to 1 litre.

- Extended Producer Responsibility (EPR). While not fully implemented like in some Western countries, efforts are underway to introduce comprehensive frameworks for managing waste from packaged goods.

- BDO register (Baza danych o produktach i opakowaniach oraz o gospodarce odpadami). The BDO requires businesses introducing packaged goods into the market to register and report their packaging materials and waste management activities, enhancing transparency and accountability in waste management practices.

Customs and import/export regulations

If you intend to sell goods in Poland and operate from another EU member state, it’s important to monitor the thresholds that impose reporting obligations under INTRASTAT, which tracks the movement of goods within the EU.

As of 2024, the values of statistical thresholds in the INTRASTAT system are as follows:

- basic threshold for arrivals: PLN 6,200,000;

- basic threshold for dispatches: PLN 2,800,000;

- detailed threshold for arrivals: PLN 103,000,000;

- detailed threshold for dispatches: PLN 150,000,000.

Poland’s customs and import/export regulations adhere to strict standards to ensure compliance with international trade laws and protect consumers. Even major marketplaces like Shein and Temu are not exempt – recently, these platforms faced scrutiny from Poland’s Ministry of Economic Development and Technology (MRiT) for potential violations, including insufficient pricing transparency, ambiguous product information, and environmental claims. MRiT has requested clarification from both platforms to address these issues and uphold regulatory transparency and consumer rights in cross-border commerce.

What’s more, on 1 January 2023, the Omnibus Directive took effect. It mandates that e-commerce platforms clearly display prices, including discounts, and provide accurate product details. Sellers must disclose the lowest price observed in the past 30 days if they advertise a product with a previous higher price. Violations can lead to penalties by the Provincial Inspectorate of Trade Inspection, with fines reaching up to PLN 20,000 for first-time breaches and up to PLN 40,000 for repeated infractions within a year.

If you’re looking for detailed information about company registration in Poland, please visit the official government website (available in English).

E-commerce in Poland

Poland has seen a remarkable surge in e-commerce in recent years, highlighted by a fivefold increase in the value of the B2C e-commerce market. According to PwC’s estimates, B2C e-commerce is expected to reach PLN 155 billion by 20252.

Approximately 30 million internet users regularly access the internet in Poland, with a significant 79% having made online purchases. Among these users, 75% prefer shopping at Polish online stores, citing convenience, speed, and a wide array of products and brands at attractive prices as key factors. Analytical consumers, comprising the largest segment of Polish shoppers (42%), also appreciate the opportunity for thorough and relaxed product research during online shopping, enhancing their purchasing decisions3.

This e-revolution is bolstered by the expanding digital infrastructure and growing popularity of mobile commerce, which now constitutes over 50% of all online transactions.

So, what exactly are Poles adding to their online shopping carts? According to the “Polaków portfel własny. Polacy w sieci” Santander Bank report4, the products most often bought online include:

Marketplaces in Poland

Several popular marketplaces dominate the Polish e-commerce landscape:

As the first-ever Polish e-commerce marketplace, it still stands tall as the nation’s favourite hub for online shopping. It has earned the prestigious Superbrands 2021 title as Poland’s most trusted brand, with 81% of internet users considering it their go-to destination for online purchases5. Allegro offers virtually every product, from electronics and fashion to home goods and automotive supplies. It has set the standard for online shopping in Poland, providing a seamless and trustworthy shopping experience.

Known for its extensive range of listings, OLX allows users to shop for both new and second-hand items, advertise their services, and seek housing and job opportunities.

The store’s original assortment included books, movies, music, and stationery, catering to avid readers and pop culture enthusiasts. Today, the marketplace offers virtually everything – from cosmetics and electronics to gardening tools.

These fashion marketplaces offer a wide range of clothing, footwear, and accessories for fashion-forward consumers. Zalando is the most popular one, standing out for its extensive selection of international and local brands, as well as convenient delivery options and easy returns.

A top online shoe retailer in Poland, eobuwie provides an extensive selection of footwear and accessories for men, women, and children. Customers can explore products from renowned brands at competitive prices, with a diverse range of sizes and styles to choose from. The brand’s esize.me service enriches the shopping experience by offering personalised size recommendations tailored to individual foot measurements.

Consumer behaviour and preferences

Language preferences

While English is widely understood in Poland, particularly among the younger population and in urban areas, localising content into Polish can notably boost engagement and increase conversion rates.

According to the 2020 “Can’t Read, Won’t Buy” report by CSA Research6, 65% of consumers prefer content in their native language, 73% seek product reviews in their language, and 40% are hesitant to purchase if information is not available in their preferred language. Consequently, if a company opts not to localise the shopping experience, it faces the risk of potentially losing 40% or more of its market potential.

It’s also worth adding that Poland is currently home to nearly 3.2 million Ukrainians, compared to 1.5 million before the war. As a result, many platforms now offer content in both Polish and Ukrainian to appeal to a wider audience.

Holidays and seasonal trends

In Poland, as in many other countries, holidays and special occasions drive significant sales spikes for e-commerce businesses. Key dates include Christmas, Easter, Black Friday, and Cyber Monday, which are crucial for planning marketing campaigns and promotions.

Payment methods

Polish consumers choose quick, convenient, and secure payment methods when shopping online.

Traditional bank transfers have been superseded by options like pay-by-link and BLIK. The latter is poised to become the preferred online payment method in Poland – by the end of March 2024, BLIK was actively used by 16.3 million users7.

Additionally, the rising popularity of deferred payments is noteworthy, with 48% of Poles having used the “Buy Now, Pay Later” method at least once8. For e-commerce businesses, offering BNPL options significantly boosts the average value of digital shopping carts, highlighting their importance in driving sales and customer satisfaction.

Delivery methods

Parcel lockers have emerged as the preferred delivery option for shoppers in Poland, with 81% of respondents indicating their preference for this method9. These automated lockers allow customers to collect their parcels at their convenient time and from easily accessible points.

Notably, Paczkomat® InPost remains the dominant choice among parcel locker users, selected by 94% of respondents for its practicality and reliability. It also leads in motivating online shopping behaviours, cited by 95% of users who opt for this delivery method10. Competitors include ORLEN Paczka and Allegro Box.

The popularity of these pick-up points reflects the demand for flexible delivery options that accommodate busy lifestyles and provide secure package collection at user-oriented locations.

Demographics

Online customers in Poland consist of 51% women and 49% men11 across the following age groups:

According to the “E-commerce in Poland in 2023” report12, shopping via social media is relatively uncommon, with only 19% of people having tried it at least once. Still, this shopping method is more popular among women (23%) and those aged 15–24 (28%).

Summary

Entering the Polish market presents an attractive opportunity for businesses seeking to establish a stronger presence in Central Europe. Nowadays, Poland offers access to a dynamic economy and a rapidly growing e-commerce sector – by aligning their strategies with local preferences and leveraging Poland’s digital advancements, businesses can effectively boost their sales and enhance market penetration.

FAQ

Yes, Poland has been part of the EU since 2004.

For detailed information about setting up a business and company registration in Poland, visit the official government website.

Yes, Poland is among the 26 European countries that constitute the Schengen area.

Footnotes

1 Izba Gospodarki Elektronicznej. (2023). Dekada polskiego e-commerce. Raport e-Izby. https://eizba.pl/wp-content/uploads/2023/02/Raport_e-Izby_Dekada_polskiego-e-commerce_2023.pdf

2 Izba Gospodarki Elektronicznej. (2023). Dekada polskiego e-commerce. Raport e-Izby. (2023). https://eizba.pl/wp-content/uploads/2023/02/Raport_e-Izby_Dekada_polskiego-e-commerce_2023.pdf

3 Gemius Polska. E-commerce w Polsce 2023. (2023). https://www.gemius.pl/wszystkie-artykuly-aktualnosci/id-79-internautow-kupuje-online-raport-e-commerce-w-polsce-2023-juz-dostepny.html

4 Santander Consumer Bank. Polaków portfel własny. Polacy w sieci. (2024). https://www.santanderconsumer.pl/gfx/santander/userfiles/_public/o_banku/raport_ppw_polacy_w_sieci.pdf

5 Allegro. Dlaczego Allegro jest najpopularniejszym marketplace w Polsce. https://allegro.pl/artykuly/sprzedajacy/dlaczego-allegro-jest-najpopularniejszym-marketplace-w-polsce-d2AzMVkvnCy

6 Donald A. DePalma, Paul Daniel O’Mara. Can’t Read, Won’t Buy – B2C. Analyzing Consumer Language Preferences and Behaviors in 29 Countries. (2020). https://csa-research.com/Featured-Content/For-Global-Enterprises/Global-Growth/CRWB-Series/CRWB-B2C

7 BLIK. Ponad pół miliarda transakcji BLIKIEM i 16,3 mln aktywnych użytkowników w I kw. 2024 r. (2024). https://blik.com/ponad-pol-miliarda-transakcji-blikiem-i-16-3-mln-aktywnych-uzytkownikow-w-i-kw-2024-r

8 Comfino. Płatności ratalne i odroczone. (2023). https://comfino.pl/wp-content/uploads/2023/12/Comfino-Platnosci-ratalne-i-odroczone.pdf

9 Izba Gospodarki Elektronicznej. (2023). Dekada polskiego e-commerce. Raport e-Izby. https://eizba.pl/wp-content/uploads/2023/02/Raport_e-Izby_Dekada_polskiego-e-commerce_2023.pdf

10 InPost. Kantar: 94% Polaków kupujących online wybiera Paczkomat® InPost. (2024). https://inpost.pl/aktualnosci-kantar-94-polakow-kupujacych-online-wybiera-paczkomatr-inpost

11 Gemius Polska. E-commerce w Polsce 2023. (2023). https://www.gemius.pl/wszystkie-artykuly-aktualnosci/id-79-internautow-kupuje-online-raport-e-commerce-w-polsce-2023-juz-dostepny.html

12 Gemius Polska. E-commerce w Polsce 2023. (2023). https://www.gemius.pl/wszystkie-artykuly-aktualnosci/id-79-internautow-kupuje-online-raport-e-commerce-w-polsce-2023-juz-dostepny.html

Location: Central Europe

Location: Central Europe

Leave a Reply